Check out what’s clicking on FoxBusiness.com

Berkshire Hathaway, the investment company owned by Warren Buffett, continues to reduce its stake in the Chinese electric automaker BYD.

Berkshire sold 2.53 million Hong Kong-listed shares worth $86.3 million, according to a stock exchange filing.

The shares which were sold on June 19, reduced Berkshire’s holdings in BYD’s shares from 9.21% to 8.98%.

Berkshire has been steadily been selling shares. The company had not sold shares in the automaker before last August.

BUFFETT’S FIRM CUTS STAKE IN CHINESE AUTOMAKER

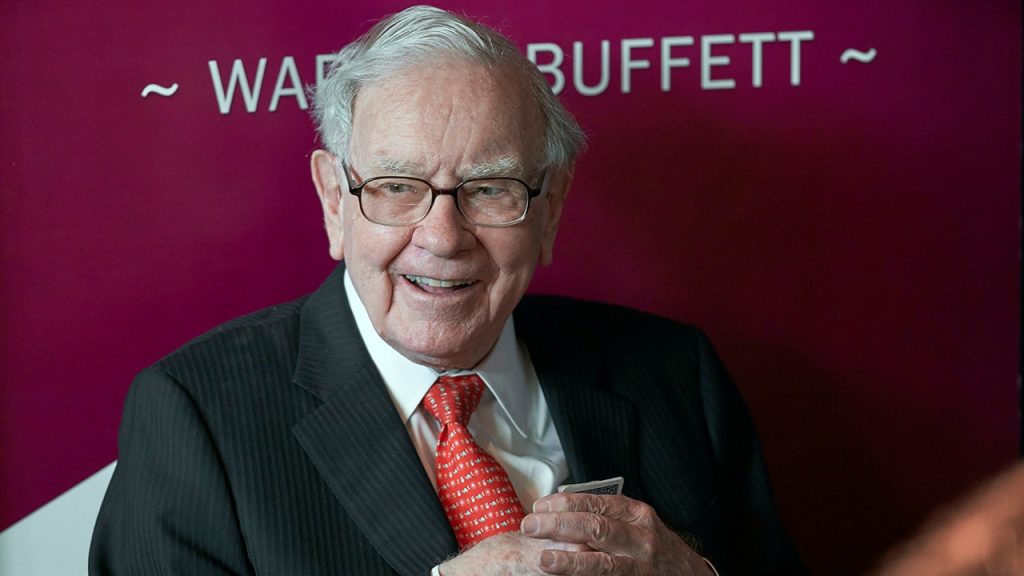

Warren Buffett, chairman and CEO of Berkshire Hathaway. (AP Photo/Nati Harnik, File / AP Newsroom)

Last month, Buffett’s company sold nearly 2 million shares, brining his stake to below 10%.

In February, Berkshire sold nearly 95 million of its original 225 million shares, according to a filing with the Hong Kong stock market.

That is in addition to the sale of another 4 million BYD shares.

WARREN BUFFETT’S BERKSHIRE HATHAWAY INCREASING STAKES IN JAPAN TRADING FIRMS

BYD’s Atto 3 electric SUV. ( REUTERS/Adnan Abidi / Reuters Photos)

Berkshire invested in the company in 2008, paying $232 million for a stake.

BYD sold nearly 1.9 million cars last year including pure electrics, plug-ins and hybrids.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BRK.A | BERKSHIRE HATHAWAY INC. | 509,999.99 | -1,480.01 | -0.29% |

| BRK.B | BERKSHIRE HATHAWAY INC. | 335.33 | -1.61 | -0.48% |

Many investors follow Buffett’s investments because of his remarkably successful track record over the years.

Reuters contributed to this report.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal