Former U.S. attorney Marc Litt joined ‘Fox & Friends Weekend’ to discuss the background on extradition and how SBF’s ex-girlfriend is reportedly cooperating with officials.

A small town in western Massachusetts is bracing for the potential fallout from the collapse of the FTX cryptocurrency exchange after ex-FTX executive Ryan Salame invested $6 million into restaurants and small businesses in the town. The bankruptcy of FTX and its affiliates has likely wiped out the funds of countless investors, sparking concern about the financial distress spreading to other ventures linked directly or indirectly to FTX.

Salame, who was the co-CEO of FTX Digital, has reportedly invested around $6 million in several restaurants and small businesses in Lenox, Massachusetts, since the summer of 2021. Lenox is a quaint town of about 5,000 residents located in western Massachusetts’ Berkshire County roughly 20 miles away from Salame’s hometown of Sandisfield.

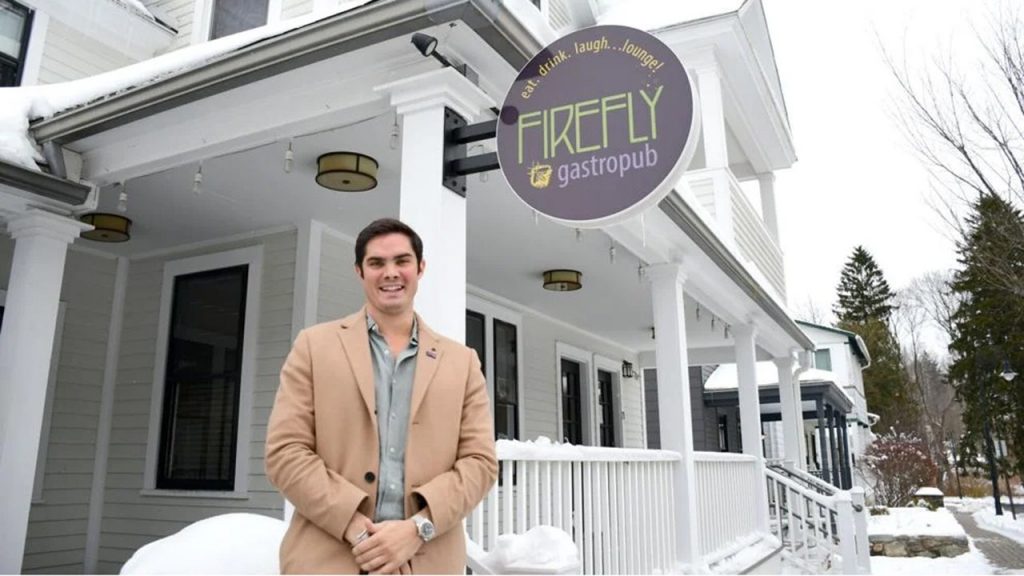

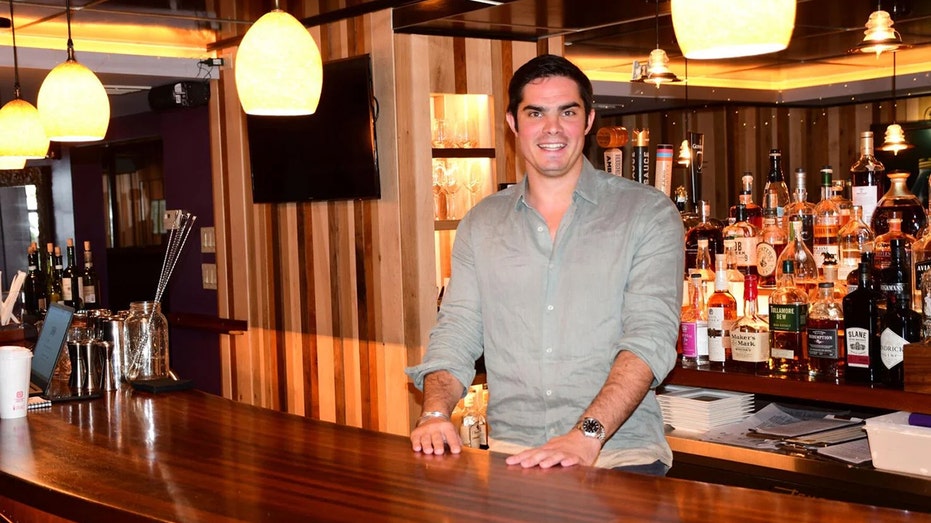

The Berkshire Eagle reported that Salame owns several eateries in Lenox, including Firefly Gastropub & Catering Co., The Olde Heritage Tavern, Sweet Dreams bakery and ice cream shop, and a food truck called The Lunch Pail, among others. Salame reportedly resides primarily in the Bahamas, where FTX is headquartered, and isn’t involved in the day-to-day management of the small businesses.

TOM BRADY SUED BY PATRIOTS FAN WHO LOST $30K IN FTX COLLAPSE

Sandisfield native Ryan Salame stands in November 2021 outside the Firefly Gastropub. (Gillian Jones/Berkshire Eagle)

While an air of uncertainty has lingered following the FTX meltdown, the Eagle reported that there has been little outward sign of change in the local businesses, and they’ve continued to operate as usual in the weeks since the crypto firm and its affiliates imploded.

According to bankruptcy filings, Salame received a $55 million loan from Alameda Research – the hedge fund and trading arm of FTX that Sam Bankman-Fried co-founded. Bankman-Fried reportedly received a $1 billion personal loan from Alameda while FTX’s former engineering chief Nishad Singh got a $543 million loan from the hedge fund.

FTX EXEC RYAN SALAME TURNED ON SBF; ALERTED AUTHORITIES ABOUT IMPROPER PAYMENTS TO ALAMEDA

Ryan Salame has invested over $6 million into the downtown restaurant scene in Lenox and now owns close to half the commercial district’s full-service dining establishments. On Friday, Salame’s corporate home, FTX Group, filed for bankruptcy protecti (Gillian Jones/Berkshire Eagle)

Salame made headlines last week after Bankman-Fried’s arrest in the Bahamas on Monday when Bahamian officials claimed in court documents filed Wednesday that Salame informed them on November 9th that client assets “which may have been held” at the FTX exchange were transferred to Alameda to “cover financial losses” at the hedge fund.

He reportedly warned that the transfers “were not allowed or consented to” by the clients and said the only individuals with access to carry out the unauthorized transfers were Bankman-Fried, Singh, and co-founder Zixiao “Gary” Wang.

FTX FOUNDER SAM BANKMAN-FRIED REPORTEDLY TO AGREE TO EXTRADITION, REVERSE COURSE AT NEXT BAHAMAS COURT HEARING

By one tally, Ryan Salame’s giving in the 2022 midterm elections ranked him 11th in the country among donors to one of the two major parties. (Gillian Jones/Berkshire Eagle)

At the time, FTX was under mounting financial pressure as the exchange experienced the crypto equivalent of a bank run caused by a $6 billion surge of client withdrawals. FTX, which was once valued at $32 billion, and its affiliates filed for bankruptcy on November 11th.

The Wall Street Journal previously reported that Caroline Ellison, who was the CEO of Alameda, told Alameda staff in early November that FTX used customers’ funds to shore up Alameda’s finances and that she, Bankman-Fried, and other members of the firms’ leadership were aware of the decision.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

As of December 18th, Bankman-Fried is the only executive from FTX or Alameda to be charged with a crime. He faces eight federal charges that carry a maximum combined sentence of 115 years in prison.

Fox Business’ Breck Dumas contributed to this story.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal