Housing Works CEO Charles King discusses the recreational cannabis business and his dispensary scheduled to open December 29 on ‘Kennedy.’

The legal cannabis brand launched by the family of late Grateful Dead star Jerry Garcia has stopped operations in California amid a thriving black market for marijuana and a challenging environment for legitimate businesses.

A spokesperson for Garcia Hand Picked, which the deceased guitarist’s family launched in 2020, confirmed to SFGATE that the business has left the Golden State and didn’t specify a return date.

“We’re taking a pause in California. We want to ensure CA consumers have the highest quality flower for the long term, so we are choosing a new local partner for cultivation, production, sales and distribution of Garcia Hand Picked in CA,” a spokesperson from the brand’s parent company Holistic Industries told the outlet.

FDA CALLS ON CONGRESS TO CREATE NEW REGULATIONS FOR HEMP-DERIVED CBD PRODUCTS

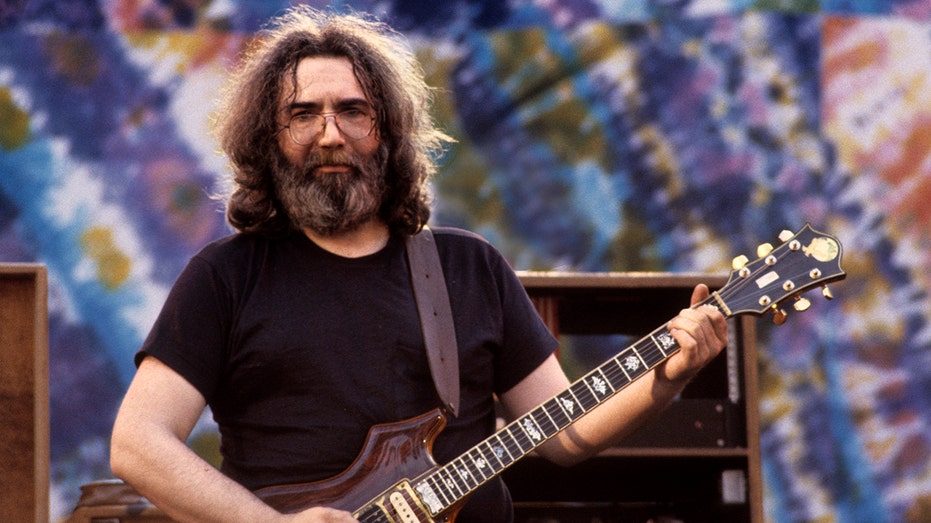

BERKELEY, UNITED STATES – MAY 22: Jerry Garcia performing with the Grateful Dead at the Greek Theater in Berkeley on May 22, 1982. () (Photo by Clayton Call/Redferns / Getty Images)

The Garcia Hand Picked brand will remain available in Colorado, Maryland, Michigan, Massachusetts, and Oregon. But given that the late musician was born in California and rose to fame in the Bay Area, the decision to indefinitely pause operations in the state was difficult.

Cannabis consultant Andrew DeAngelo told SFGate, “This was a hard decision for them, they love California. They were born and bred here. This is very painful for them, I guarantee that.” DeAngelo added, “Not only is Garcia leaving, a lot of people are leaving. It’s a real shame California is losing out.”

NEW YORK’S FIRST LEGAL WEED SHOP OPENS, OFFICIALS HOPE BUDDING INDUSTRY WILL BE TAX REVENUE BOON

The company behind a cannabis mega-factory in California is hoping federal legalization of the substance will allow it to expand distribution of joints, oils and edibles beyond the borders of the most populous U.S. state. (Associated Press / AP Newsroom)

California legalized recreational marijuana in 2016 and has generated over $4 billion in tax revenue in the years since.

However, the state has enacted a number of taxes that make the cost of doing business prohibitive for many cannabis firms and created incentives for buyers to turn back to a booming black market that has been estimated at nearly $8 billion per year.

The state of California levies a 15% excise tax on recreational marijuana purchases. Retailers have to pay for licenses that can cost upwards of $100,000 annually and are also taxed on retail sales. Growers pay a cultivation tax of $9.25 per ounce of flowers and $2.75 per ounce of leaves. Beyond the state taxes, local county and municipal governments are also able to impose additional taxes on marijuana consumers, growers, and retailers.

BIPARTISAN MARIJUANA BANKING BILL IN PERIL AMID YEAR-END SCRAMBLE IN CONGRESS

Paying by credit card for legal marijuana at a cannabis dispensary. (iStock / iStock)

Federal tax policies have also hampered legal cannabis businesses by preventing them from accessing deductions and credits available to other companies. The ban has created an effective tax rate as high as 80% for some legal cannabis businesses, according to a U.S. Senate Finance Committee report.

On the black market, buyers and sellers can skirt all those regulations and taxes at the risk of potential prosecution. While law enforcement does raid illegal growing operations and unlicensed stores, penalties are relatively light under California law, which makes it difficult to keep bad actors from returning to the black market after their punishment.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The National Organization for Marijuana Laws (NORML) notes that possession with intent to distribute is punishable by six months imprisonment and a $500 fine – the same punishment for the sale or delivery of marijuana without a state-licensed permit or the cultivation of more than six marijuana plants without a license.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal