Rep. Roger Williams, R-Texas, discusses the collapse of First Republic Bank, the Treasury Departments reaction, Bidens new mortgage rule and the looming threat posed by Title 42s upcoming expiration.

The Federal Deposit Insurance Corporation’s (FDIC) acceptance of JPMorgan Chase’s bid to buy troubled First Republic Bank means “this part” of the U.S. banking “crisis is over,” JPM chief executive Jamie Dimon said Monday.

“This part of the crisis is over,” Dimon told reporters after an overnight deal was reached for JPMorgan to pay $10.6 billion for most of the San Francisco-based lender’s assets. “For now, let’s take a deep breath.”

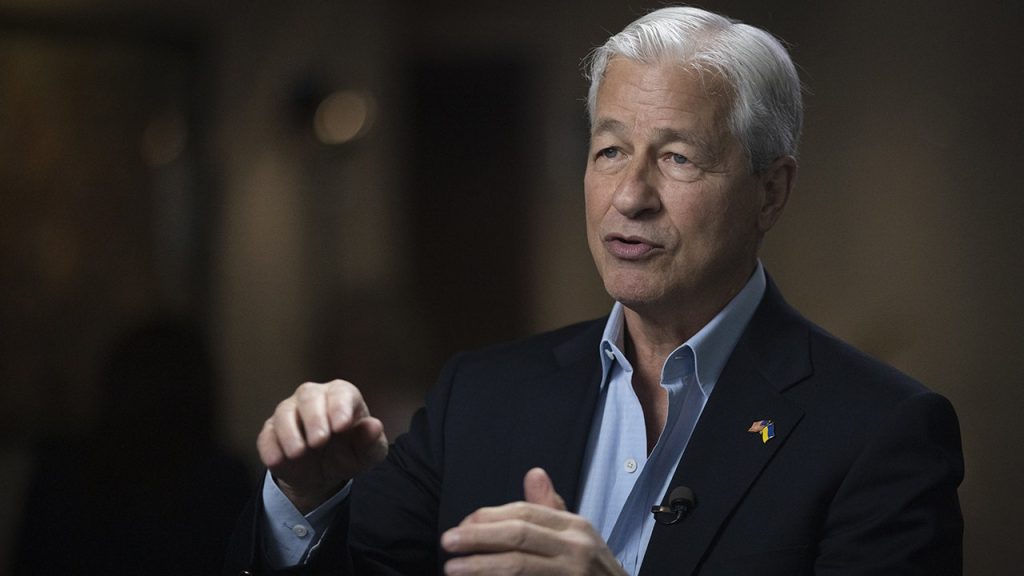

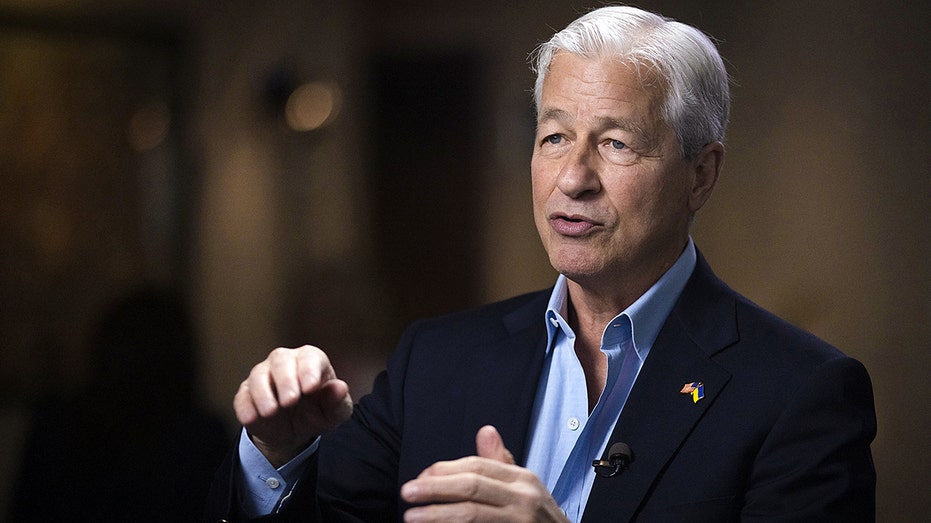

JPMorgan Chase CEO Jamie Dimon says the company’s purchase of troubled lender First Republic Bank means “this part” of the U.S. banking crisis “is over.” (Marco Bello/Bloomberg via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 141.65 | +3.38 | +2.45% |

Dimon went on to say JPMorgan’s purchase of First Republic has not changed the odds of a recession, but has stabilized the banking system.

First Republic has struggled since the collapse of Silicon Valley Bank and Signature Bank in early March, and it was widely seen as the bank most likely to collapse next.

JPMORGAN BUYS FIRST REPUBLIC: BANK SHARES RISE AS DEAL REACHED

Dimon said JPMorgan, the largest bank in the U.S., did not seek out the deal and was invited by the FDIC to make a bid along with other lenders in a competitive process.

A pedestrian walks past a First Republic Bank in San Francisco on April 26, 2023. (AP Photo/Jeff Chiu / AP Newsroom)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FRC | FIRST REPUBLIC BANK (SAN FRANCISCO CALIFORNIA) | 3.50 | -2.69 | -43.46% |

The CEO said the bank would not keep First Republic’s name.

First Republic used to be the envy of most of the industry and its clients mostly included the rich and powerful, who rarely defaulted on their loans.

SIGNATURE BANK COLLAPSE BLAMED ON ‘POOR MANAGEMENT,’ FDIC REPORT SAYS

Many of the bank’s deposits, however, were uninsured as they were above the $250,000 limit set by the FDIC. If First Republic were to fail, its depositors might not get all their money back, worrying analysts and investors alike.

FDIC representatives speak with customers outside of the Silicon Valley Bank headquarters in Santa Clara, California, on March 13, 2023. (Reuters/Brittany Hosea-Small / Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

These fears materialized in April when the bank’s recent quarterly results showed that depositors pulled more than $100 billion out of the bank as the banking crisis was affecting Silicon Valley Bank and New York’s Signature Bank.

FOX Business’ Lawrence Richard and The Associated Press contributed to this report.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal