NS&I has announced the Premium Bonds prize fund rate will rise from 3.3 percent to 3.7 percent from the upcoming July 2023 prize draw.

The rate boost will see an additional £39million in prizes become available for Bond holders and with the odds of each £1 Premium Bond winning a prize remaining at 24,000 to one, there are more chances each month for customers to win prizes worth between £50 and £100,000.

Alongside this, effective from today, NS&I has also increased the interest rate for young savers holding its Junior ISA, with the rate increasing to 3.65 percent up from 3.4 percent.

According to NS&I, the change will see more than 89,000 savers aged under 18 benefit.

NS&I chief executive, Dax Harkins, said: “This is now the sixth prize fund rate increase for Premium Bonds in just over a year, making it the highest it’s been in over 15 years.

READ MORE: Premium Bonds prizes and inheritance tax – are they liable for the tax?

“With the changes, we’re expecting to pay out more than £374million to winners in July with more higher value prizes, meaning that, each month, more lives will be changed by Premium Bonds.

“This is the second interest rate increase for Junior ISA this year, giving a boost to over 89,000 young savers as we continue to help inspire a stronger savings culture.”

The Premium Bonds prize fund rate was last raised from 3.15 percent to 3.3 percent for the March 2023 prize draw, following a 0.15 percent boost in January.

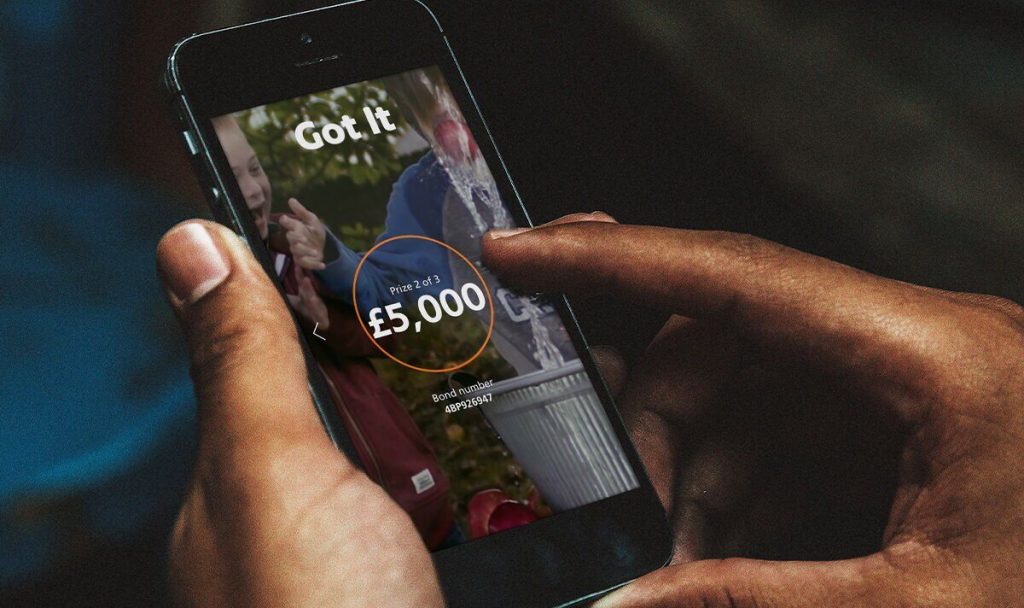

NS&I Premium Bonds work as a savings account that offers account holders the chance to win extra cash, tax-free, at the start of every month through randomly generated prize draws.

Prizes are split into three value bands – higher, medium, and lower – and each band receives a percentage share of the monthly prize fund.

Prizes in the higher band range from £1million (only two of these can be won) to £5,000, while the medium and lower bands award people the chance to win between £1,000 and £500, and £100 and £25, respectively.

The new changes to the Premium Bond prize fund rate are estimated to bring the number of prizes available to a staggering 5,054,415 worth up to £374,026,425.

June’s prize draw marked the 66th birthday of NS&I Premium Bonds and saw more than 121 billion bonds eligible to win.

A total of 5,061,328 prizes worth £334,047,650 were paid out, with the two new millionaires hailing from Essex and South Gloucestershire. The winners won from Bonds purchased n 2005 and 2020 respectively.

Commenting, Myron Jobson, senior personal finance analyst, interactive investor, said: “NS&I has once again sweetened its popular flagship product in a bid to meet a lofty target set by the Government to attract £7.5billion from savers in the current tax year, which is 25 percent more than the £6billion target for the previous year.

“It is a tall order for the Government-sponsored bank facing stiff competition from other savings providers. Easy access savings rates have hit four percent for the first time since 2009, and market-leading one, two, three and five-year fixed bonds all offer 5.3 percent or more according to Moneyfacts.”

Mr Jobson continued: “The Premium Bonds prize fund rate will hit a 15-year high from next month – but that does not mean the average person will get the heightened rate on their savings.

“Premium Bonds can be fun lottery-style alternatives to an easy access savings account and might tempt some savers hoping for good luck to bolster their wealth amid the cost of living crisis. But the fact remains that while some savers might be lucky enough to hit the jackpot or win big early on, others may save and wait for long periods for even a small return. it still pays to shop around for the best deal.”

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal