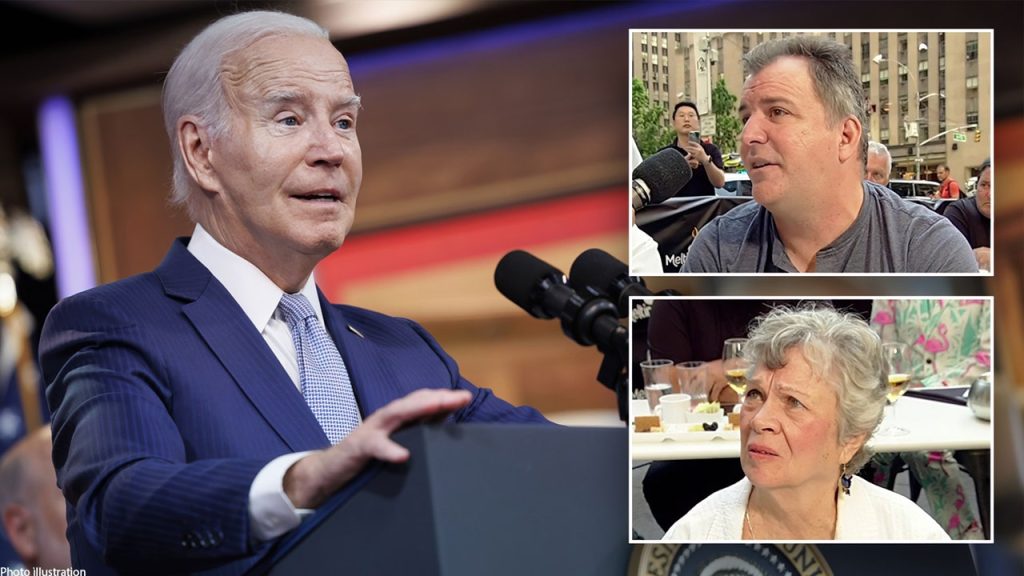

‘The Big Money Show’ co-host Brian Brenberg speaks with voters in Fox Square about American’s credit rating downgrade.

American voters are not pleased – but also not surprised – with the latest negative rating regarding the U.S. economy.

“We’re losing our standing in the world, it’s making us look bad in the world. We can’t spend money we don’t have. Families can’t spend money they don’t have,” a voter named Al told FOX Business co-host Brian Brenberg on Fox Square during a “Varney & Co.” appearance Wednesday.

“Yet this country doesn’t seem to say no,” he continued. “Every time somebody wants something, the political forces that be, say, ‘Okay, we’ll just print more money.’”

Those comments come on the heels of ratings agency Fitch announcing a downgrade of the United States’ long-term foreign-currency issuer default rating to “AA+” from “AAA,” saying the downgrade “reflects the expected fiscal deterioration” and the nation’s heavy debt burden.

NEW SURVEY SHEDS LIGHT ON CONSUMER DEBT

Fitch pointed towards America’s “erosion of governance,” rising deficits, and tightening by the Federal Reserve. It also said it expects the U.S. economy to slip into a mild recession in the fourth quarter.

U.S. voters weigh in on the Biden economy and latest credit rating downgrade on Fox Square in a “Varney & Co.” appearance on Wednesday, August 2, 2023. (Fox News)

U.S. Treasury Secretary Janet Yellen led the charge in pushing back on the rating in a statement on Tuesday, claiming that old data was used and credit conditions have improved under the Biden administration. She put additional onus on Trump-era woes.

“Fitch’s quantitative ratings model declined markedly between 2018 and 2020 – and yet Fitch is announcing its change now, despite the progress that we see in many of the indicators that Fitch relies on for its decision,” Yellen’s statement said. “Many of these measures, including those related to governance, have shown improvement over the course of this Administration, with the passage of bipartisan legislation to address the debt limit, invest in infrastructure, and make other investments in America’s competitiveness.”

“[Bidenomics] hasn’t been working since the first day he took office,” another voter Gene told Brenberg. “This doesn’t overly concern me as far as the credit rating, but it’s not good for the confidence of the economy in general.”

Former U.S. International Trade Commission Chief Peter Morici discusses the U.S. debt downgrade and nationwide rise in gas prices on ‘Varney & Co.’

Gene, who identified as an “average New Yorker,” added that inflation has already been “detrimental” when it comes to electric bills and grocery costs.

“This is just another straw in the haystack that’s really just driving our economy in a downward spiral. And it’s reflecting,” Gene noted, “every day Americans are feeling the strain.”

With the credit downgrade adding onto an overall gloomy economic landscape, other voters implied that fiscal issues could sway their 2024 candidate decisions.

“We’re losing our standing in the world, it’s making us look bad in the world. We can’t spend money we don’t have… yet this country doesn’t seem to say no.”

“I’m on a small pension and the economy is killing it, the inflation’s killing it, and I’m spending more each month and I’m making less,” retired teacher Kathy said on Fox Square.

“So I have a big decision to make about who’s going to be the next president.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Republican voters in Iowa and South Carolina say the economy is their top issue, a new Fox Business poll shows.

Investors use credit ratings to assess the risk profile of companies and governments when they raise financing in the debt capital markets. Generally, the lower a borrower’s rating, the higher its financing costs.

The White House Council of Economic Advisers did not immediately return Fox News Digital’s request for comment or reactions to the voter quotes.

READ MORE FROM FOX BUSINESS

FOX Business’ Breck Dumas contributed to this report.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal