Ernst & Young chief economist Gregory Daco and Strategic Wealth Partners investment strategist Luke Lloyd discuss whether moderating inflation warrants the Fed ending rate hikes on ‘Cavuto: Coast to Coast.’

The Vanguard Group pulled in a net $25.7 billion into its exchange-traded funds (ETF) over the first quarter to best its biggest competitor Blackrock in totals since Jan. 1, etf.com reported.

The inflows were powered by $19.1 billion of investments into equity products.

WHAT ETFS ARE GOOD INVESTMENT CHOICES FOR NEW COLLEGE GRADS

Data compiled by etf.com showed Vanguard’s fixed-income ETFs pulled in $6.6 billion during the quarter. The top asset-gathering fund was the Vanguard S&P 500 ETF, which brought in $4.5 billion over the same time.

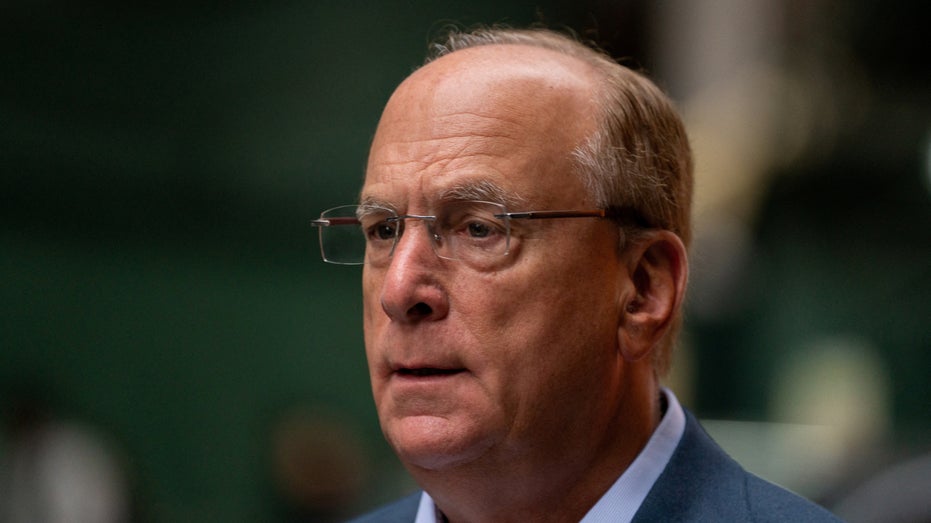

Larry Fink, Chairman and CEO of BlackRock, arrives at the DealBook Summit in New York City, on Nov. 30, 2022. (Reuters/David ‘Dee’ Delgado)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 689.29 | +18.56 | +2.77% |

Meanwhile, BlackRock’s iShares unit lost $500 million, Vanguard said. Despite the loss in revenue, iShares remains the largest ETF issuer with $2.3 trillion in assets across 384 U.S.-listed products.

TOP BOND ETFS FOR 2023

Vanguard holds $2 trillion in assets across 82 of its U.S.-domiciled funds.

In the first quarter of 2023, U.S.-listed ETFs fell 18% to $76.9 billion after reaching $91.1 billion over the first quarter of 2022.

CLICK HERE TO GET THE FOX BUSINESS APP

Pacer ETFs president Sean O’Hara reveals the best ETFs to buy in an inflationary environment on ‘The Claman Countdown.’

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal