Varney & Co.’ host Stuart Varney explains why Washington lawmakers would rather bail out banks than let them fail as they did in 2008.

During his “My Take,” Monday “Varney & Co.” host Stuart Varney addressed recent banking fears raised by the specter of a 2008-like financial crisis, arguing that, 15 years ago, Washington faced a similar bailout situation, and that, now, if confronted with the same decision, politicians would likely vote to bail again.

STUART VARNEY: Back in 2008, there was an intense debate about bailing out the banks. We are not in that dire crisis situation at this point.

We have seen buyouts of troubled banks, and some “backstopping,” and pledges of insurance for depositors. Pledges of big money are still to come if needed. But what would we do if things really got out of control, as they did 15 years ago?

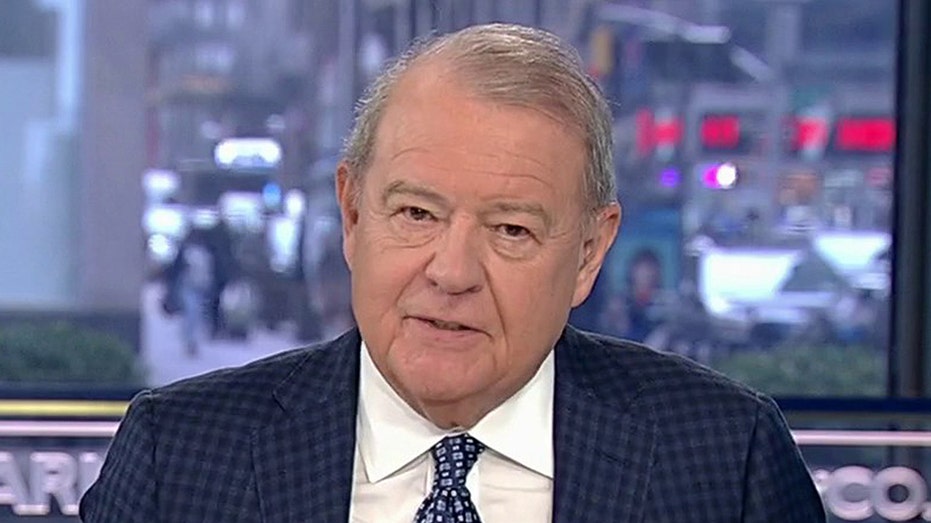

FOX Business’ Stuart Varney discusses how Washington should handle the banking crisis. (Fox News)

A little history here. When the slide began all those years ago, a bailout bill was presented to congress.

FED BLINKING IN ‘FRONT OF FINANCIAL INSTABILITY’ IS THE ‘WORST THING THEY CAN DO’ WARNS ECONOMIC ADVISER

Opposition was intense. Why, people asked, should we bail out “banksters,” as they were called? Well that first bill was rejected, and the moment it was thrown out, the stock market dropped like a stone and the bank slide got worse.

Very quickly, the politicians reversed course and voted for a full bailout. Faced with a bail or crash decision, politicians voted to bail. The calculation was bailouts are bad, but a crash is worse.

I would suggest, that if our current bank crisis heads south, and we were again faced with a bail or crash decision, the politicians would again vote to bail.

BANKING SYSTEM ON VERGE OF A ‘BEAR STEARNS MOMENT’: FORMER FDIC CHAIR

Federal Reserve Board Chairman Jerome Powell speaks during a news conference after a Federal Open Market Committee meeting (Photo by Alex Wong/Getty Images / Getty Images)

That’s a tough call for President Biden, especially because the main fault here lies with the Federal Reserve. They printed too much for too long, but bailout decisions are political decisions, and politics demand a fix.

You don’t go into any election with an economic crash on your hands.

This is a complex situation. Crises abroad, a debt ceiling crisis at home, and a crucial interest rate decision from the Federal Reserve this week. The president and the Fed are between a rock and a hard place.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal